private premium financing life insurance

The strategy allows a high net-worth individual who. Exemption or paying gift taxes.

What Is Life Insurance Premium Financing Youtube

The loan is secured.

. The Private Bank at Commerce Trust Company can help you transfer your estate or business tax-efficiently while preserving your liquidity using life. Premium finance is a strategy used by wealthy individuals and business owners to finance premiums for large life insurance policies. By borrowing money to pay for the premiums you may be able to maximize the benefit of the life insurance policy while.

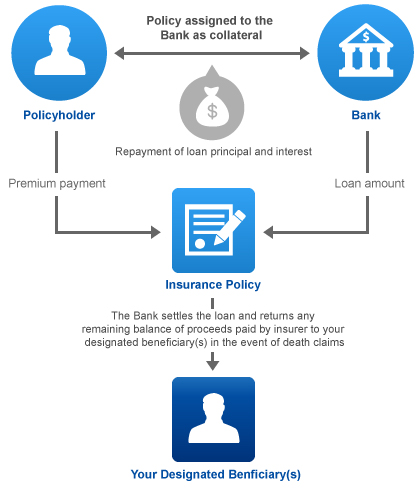

By using our website you consent to selected cookies in accordance with our Cookie Policy. Premium Financing is the borrowing of funds from a financial institution to fund a life insurance contract. Life insurance premium financing is a loan made from a bank or premium finance company to fund the lump-sum premium payable on a life insurance policy.

Global Financial Distributors GFD is a non-bank licensed insurance agency subsidiary of Synovus Bank. Private premium financing is the funding of life insurance premiums through a personal loan to an Irrevocable Life Insurance. According to the Urban Institutes latest findings the US average benchmark premium for a Silver ACA marketplace plan held by a 40-year-old nonsmoker in 2021 is 443.

Preserve Your Legacy By Financing Life Insurance Premiums. Private premium financing is accomplished using an interest only balloon note on which only interest is paid until the entire principal is due. Our advisors are dedicated to helping you secure your financial future.

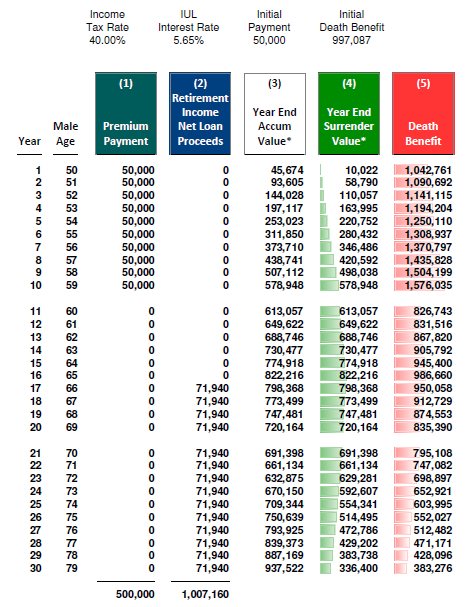

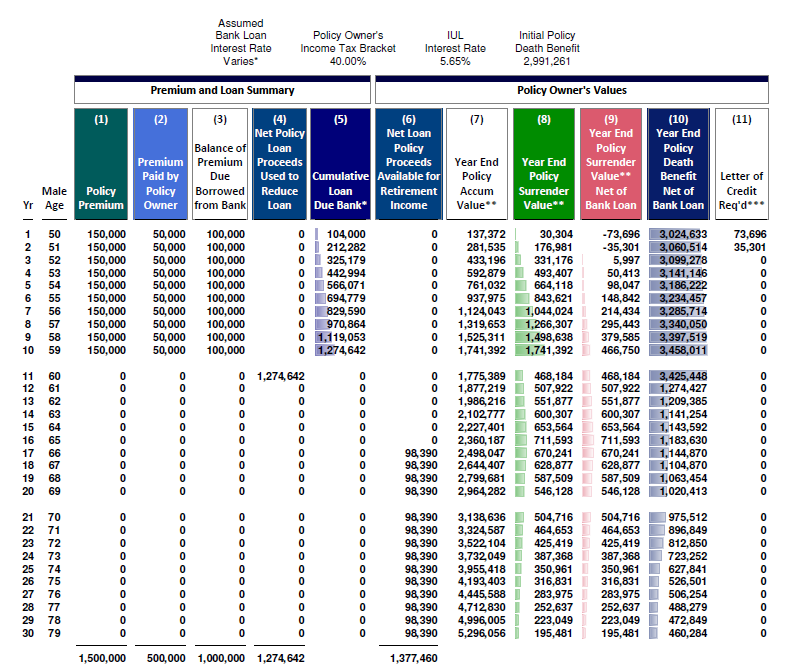

In this example the family could use private financing to fund. Life insurance premium financing becomes much more complicated on the state level as individual states have different rules and approaches. In a typical premium finance scenario a prospective policyholder obtains third-party financing to pay for life insurance premiums with minimal initial and ongoing cash flow.

Come Back And Let Us Help You Prepare. For example many private. Taking out a private mortgage to pay for top insurance coverage premiums could include fewer dangers than utilizing insurance coverage premium financing.

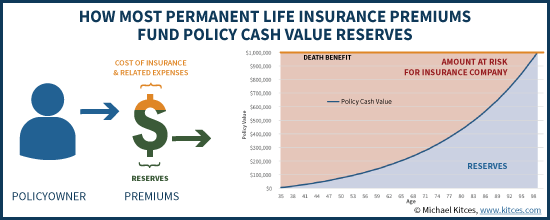

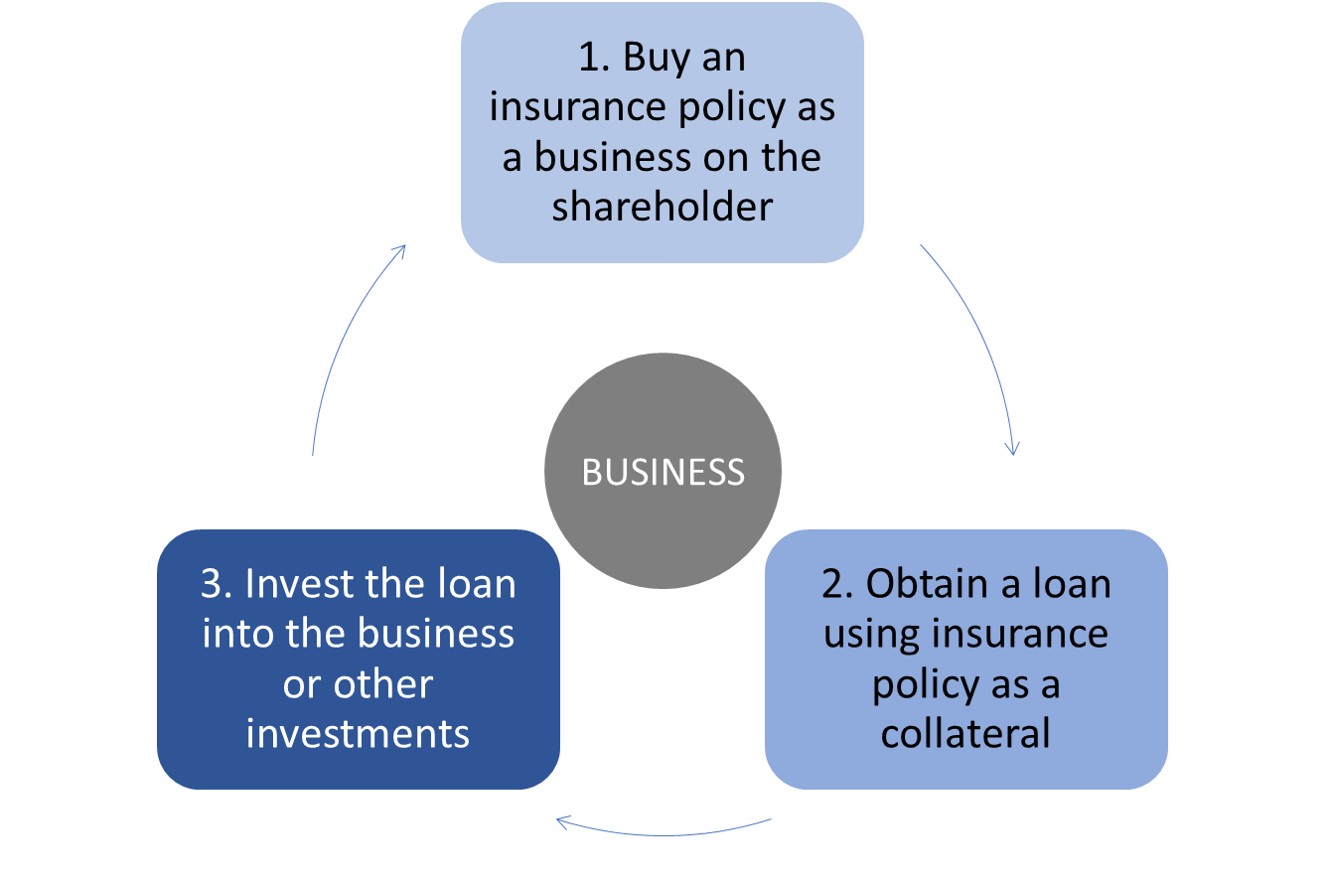

Insurance premium financing is essentially a loan that a business takes out to purchase an insurance policy such as life insurance or a retirement policy. Reviews Trusted by 45000000. Life Insurance Brokers Trust.

Here is a list of. Private Premium Financing What Is Private Premium Financing. Life insurance agent and premium financing broker for universal life policies.

Life insurance premium financing is a strategy whereby a qualified borrower accesses third-party financing to pay for large life insurance premiums. Ad Compare the Best Life Insurance Providers. This website uses cookies to improve user experience.

The insured who is often the policy owner and the insurer and one financial instrument. Ad Were a longstanding leader in financial planning and advice. We Have Options That Are Right For You.

Were the nations leading provider of high-touch customized life insurance. Life insurance premium financing can help you maximize wealth to your heirs and keep your legacy intact. Private financing typically involves borrowing the premium payments from family.

A creative solution is to create an Irrevocable Life Insurance Trust ILIT with daughters as the beneficiaries. In the right circumstances financing life insurance policy premiums may provide a client with a better internal rate of return than paying premiums out of pocket. Premium financing from just 114 for high net worth clients in 200 countries.

Ad Loans For Cancer Patients Secured By Their Life Insurance Policy. The primary benefit of. A way to plan for estate taxes One way to protect future heirs is to insure your.

Just as you can finance the purchase of real estate you can also finance life insurance premiums to increase cash flow also known as retained capital. With private financing the insured pays life insurance policy premiums with funds received from the family. Ad Loans For Cancer Patients Secured By Their Life Insurance Policy.

The lender is often directly related to a beneficiary of the policy. Premium finance is a strategy where policyowners will pay massive life insurance premiums in conjunction with borrowing from a third-party lender rather than tying up their own capital. Normally there are two parties to a life insurance policy.

Interest can be paid annually or accrued and a portion of the policys proceeds may. Ad Now Is The Time To Get Life Insurance. The borrower may be an individual a trust or a business.

How Premium Financing Works. This will vary greatly based.

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

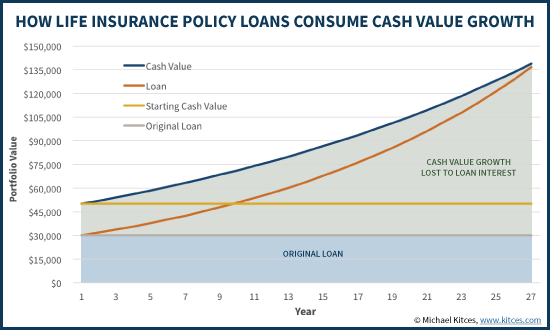

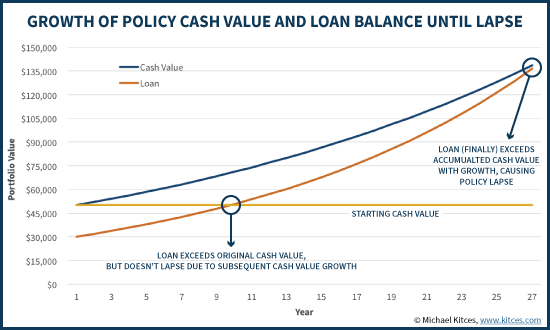

Life Insurance Loans A Risky Way To Bank On Yourself

Insurance Financing Service Insurance Services China Construction Bank Asia

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

A Rational Approach To Premium Financing Agency One

Private Family Banking System With Whole Life Insurance Paradigm Life

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Loans A Risky Way To Bank On Yourself

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

A Rational Approach To Premium Financing Agency One

5 Types Of Private Mortgage Insurance Pmi

Life Insurance As A Private Reserve

Immediate Financing Arrangement Key Things To Know

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths